Each year, HVS researches development costs from our database of actual hotel construction budgets, industry reports, and franchise disclosure documents. These sources provide the basis for our range of component costs per room.

Industry Insights

We have written thousands of articles about all aspects of hospitality, including valuations, investing, lending, operations, asset management, and much more.

HVS U.S. Hotel Development Cost Survey 2015/16

Each year, HVS researches development costs from our database of actual hotel construction budgets, industry reports, and franchise disclosure documents. These sources provide the basis for our range of component costs per room.

What Time Is The 3 PM Parade? (Should your hotel have some Mickey Mouse® in it?)

Vicki Richman attended Disney Institute. We have incorporated much of what she learned into our company. Every year we improve our company’s culture and that of our hotels. If the Walt Disney Company is any benchmark, it's clearly worth doing.

In Focus: Houston, TX

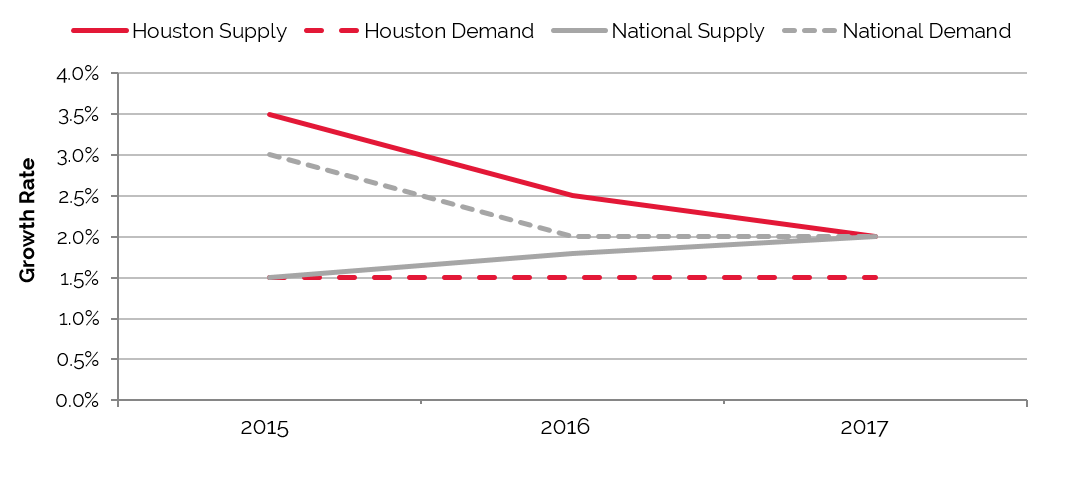

Thanks to energy-driven demand, Houston achieved record occupancy levels in 2014. The recent fall of oil and gas prices and more than 5,000 new rooms on the horizon poses a challenge to market-wide occupancy, though average rates continue to climb.

Seven Steps to Food Cost Control

Former FSU hotel school Professor Dukas' Seven Steps to Food Cost Control from his book, "How to Operate a Restaurant" provides a concise list of things to think about to effectively manage food cost.

In Focus: Hampton Roads, VA

Though on the verge of an influx of new hotel supply, demand in Hampton Roads has risen in recent years, improving occupancy and allowing hoteliers to command better rates.

In Focus: Seattle, WA

Occupancy swung above 75% for Seattle’s hotel industry in 2014, a reflection of the city’s blossoming economy. High demand has also supported strong average rates and rising hotel values.

In Focus: Denver, CO

Denver’s growth this year reflects what many hotel developers and owners have been witnessing—as a market for jobs, business, and development, Denver continues to outperform.

Room Service or is it Food Delivery?

Room service should be more than just food delivery. This article has reminders for full service hotels and ideas for limited service hotels.

Fixed Expenses Aren't Really Fixed!

In most hotel P&Ls, usually towards the bottom, is a heading called Non-Operating Income and Expense, formerly known as Fixed Expenses. Few costs are uncontrollable in a hotel. There are simply some expenses which take longer to reduce than others!

Sales Tax Audit!

This description of a sales tax audit is an opportunity to minimize potential problems with sales taxes. While focused on Minnesota much of it applies to any state with sales taxes. Do not construe this article as legal or tax advice.

Industry Insights

We have written thousands of articles about all aspects of hospitality, including valuations, investing, lending, operations, asset management, and much more.

Vicki Richman attended Disney Institute. We have incorporated much of what she learned into our company. Every year we improve our company’s culture and that of our hotels. If the Walt Disney Company is any benchmark, it's clearly worth doing.

Thanks to energy-driven demand, Houston achieved record occupancy levels in 2014. The recent fall of oil and gas prices and more than 5,000 new rooms on the horizon poses a challenge to market-wide occupancy, though average rates continue to climb.

Former FSU hotel school Professor Dukas' Seven Steps to Food Cost Control from his book, "How to Operate a Restaurant" provides a concise list of things to think about to effectively manage food cost.

Though on the verge of an influx of new hotel supply, demand in Hampton Roads has risen in recent years, improving occupancy and allowing hoteliers to command better rates.

Occupancy swung above 75% for Seattle’s hotel industry in 2014, a reflection of the city’s blossoming economy. High demand has also supported strong average rates and rising hotel values.

Denver’s growth this year reflects what many hotel developers and owners have been witnessing—as a market for jobs, business, and development, Denver continues to outperform.

Room service should be more than just food delivery. This article has reminders for full service hotels and ideas for limited service hotels.

In most hotel P&Ls, usually towards the bottom, is a heading called Non-Operating Income and Expense, formerly known as Fixed Expenses. Few costs are uncontrollable in a hotel. There are simply some expenses which take longer to reduce than others!

This description of a sales tax audit is an opportunity to minimize potential problems with sales taxes. While focused on Minnesota much of it applies to any state with sales taxes. Do not construe this article as legal or tax advice.

Robust demand in urban centers continues to drive Canadian hotel values despite high interest rate environment.