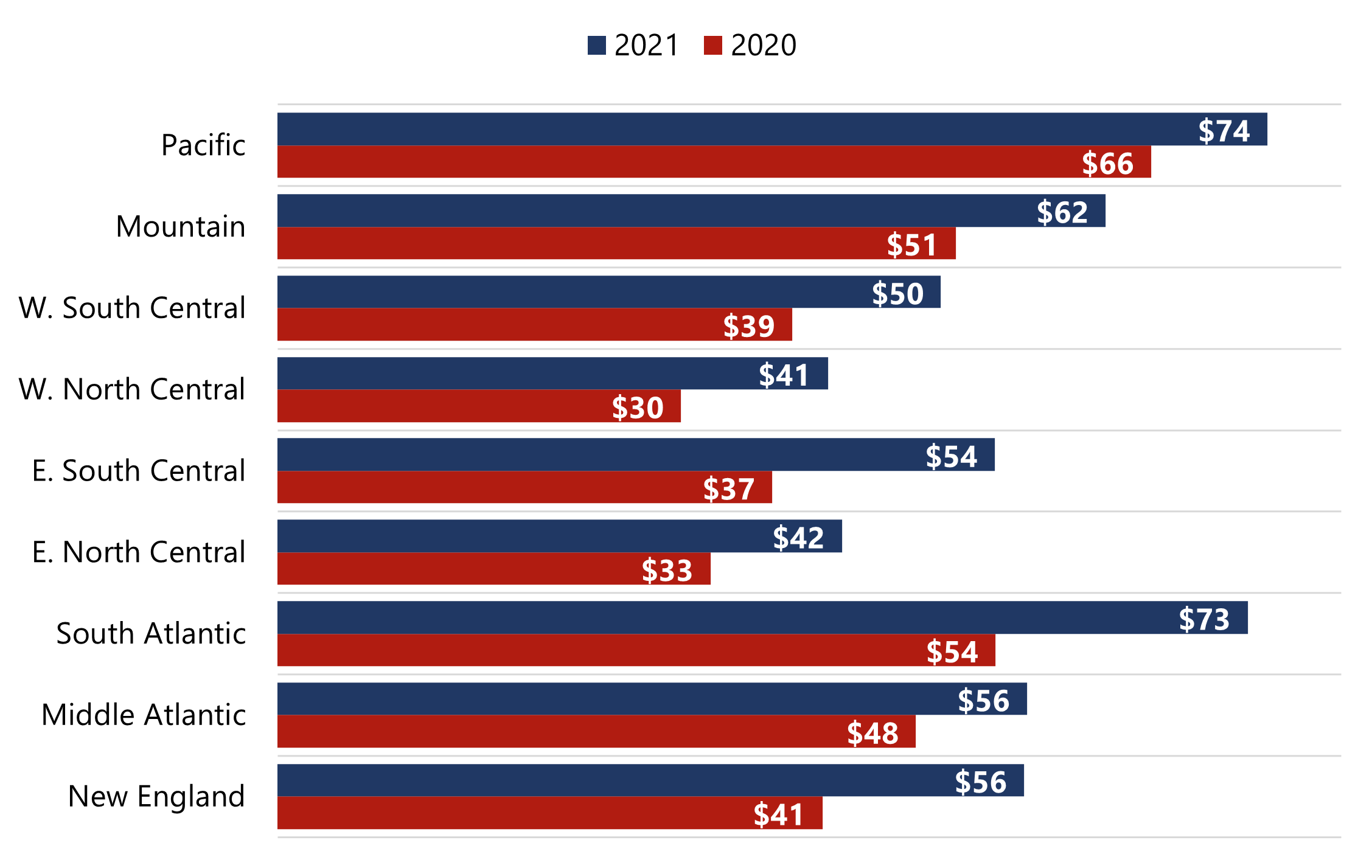

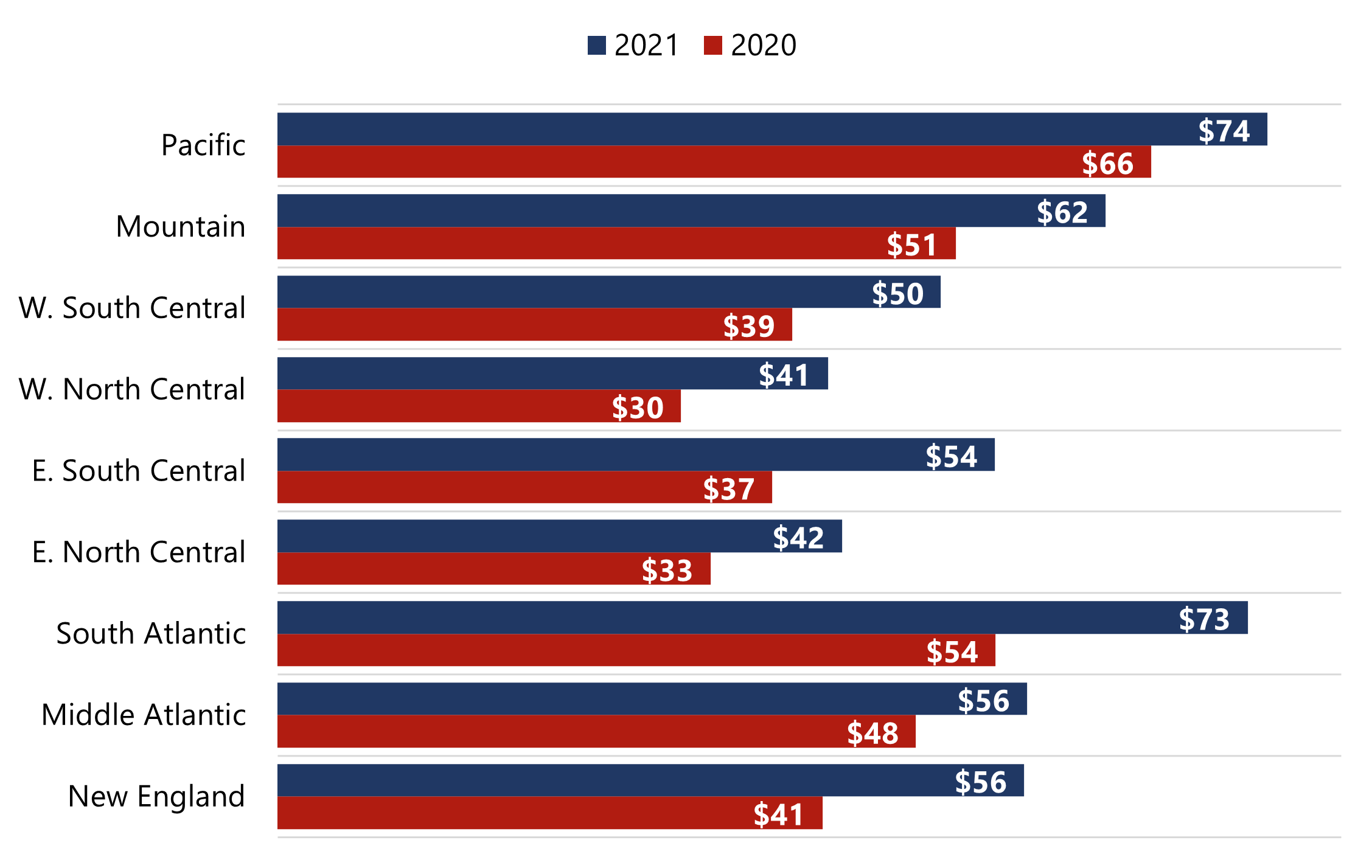

Given the significant traction in distribution of the COVID-19 vaccines throughout the United States and general international travel restrictions, leisure travel has begun to recover in 2021 and is expected to continue increasing, with Americans seeking so-called “revenge travel” to a domestic getaway. Business travel is also beginning to show signs of recovery, and some group business related to conference attendance is returning. While the lodging recovery is still rather disjointed throughout the U.S., emerging optimism has led to the restart of hotel construction and a marked increase in trading activity through the second quarter of 2021, particularly in MSAs that have demonstrated strong RevPAR recovery over the last six months. The table below illustrates U.S. hotel RevPAR by region for the year-to-date period through June 2020 and 2021. Overall, the U.S. has started to recover, with RevPAR growth range from 13% in the Pacific region to 45% in the East South-Central region, and an overall median RevPAR increase of 30%.

RevPAR By Region—YTD June Source: STR - June 2021 Lodging Review

Source: STR - June 2021 Lodging Review

Commensurate with the resurgence in transaction volume and increasingly favorable sentiment of hotel investors, financing is becoming more available. Smaller transactions are continuing to be financed through local and regional banks, in many instances supported by government-backed programs (USDA, SBA7a, and SBA 504). Mid-to-large hotel transactions are benefitting from the return of traditional forms of financing but are typically being financed at lower LTVs or a higher cost of capital given the need for subordinate debt. Conduit financing is returning but remains limited by suppressed performance over the trailing-twelve-month period.

Subsequent to the COVID-19 pandemic, several opportunistic funds were raised, and existing funds grew as investors hoped to buy distressed assets at significant discounts, typically 15–35% below 2019 valuations. Few transactions transpired, as per RCA, “between March of 2020 and February of 2021, 8% of hotel sales involved a distressed asset.”[1] Now several groups are sitting on significant amounts of capital waiting to be deployed, and with a recovery for hotels in sight, the opportunity to purchase assets at significant discounts has dwindled. There will be some potential for distressed acquisitions or note sales, primarily in urban markets; however, with limited transactions and several buyers ready with capital at hand, discounted pricing relative to 2019 levels will likely be limited.

As a result of a dearth of investment opportunities and the ramping-up of more traditional forms of financing, several opportunistic or distressed funds have shifted to a lending strategy. These funds are a new source of capital to address deferred maintenance/PIP requirements, acquisitions, and maturing debt, as well as recovery capital as forbearance periods end on loan payments and debt covenants. In commercial real estate, it is always important to understand what financing options are on the table, how to best structure the capital stack, and the trade-offs of each source of capital.

The new funds raised following the onset of the pandemic were typically backed by opportunistic investors who expect a higher return. This translates to higher coupon rates that force these funds primarily into mezzanine or preferred equity positions. These types of groups typically benefit from their ability to transact on complex deals with expedited timelines, which often leads to lending on distressed hotels. Additionally, this subordinated debt commonly comes into play at the end of a project when construction cost materially exceeds the budget. These loans are currently being structured with an 18-month term or longer and are designed to be refinanced with a permanent loan once cash flow reaches stabilization or after construction is completed. However, the track record of these newly formed groups and their ability to execute is a factor borrowers should strongly consider.

Existing lending groups that have experience and exposure to the hospitality industry have new investment vehicles designed primarily to assist in distressed situations due to the timing constraints of a transaction or a cash flow problem at the asset level. Additionally, these groups are on the table for bridge lending related to acquisitions or renovations, as well as new construction financing. Financing products vary greatly and run the capital stack. These loans typically have a shorter horizon between two and three years with options for extensions. These groups are favorable given their historic track record and high likelihood of execution; however, their pricing is still well above conventional and CMBS loans. Furthermore, given these funds’ capital resources, they typically have a large check size with a minimum around $15 million on a 60–75% LTV, which narrows the deals that qualify.

Lastly, we have seen new partnerships that were historically either owners or developers that have expanded their capabilities to encompass a lending arm. These groups typically have a history of success and are able to understand the challenges and opportunities from an operational and development perspective, which is a benefit to borrowers. These partnerships play in a variety of positions along the capital. However, given the scale of these partnerships, their cost of capital is much higher, and the extra expense is typically passed onto the borrower. Additionally, these groups may limit their deal supply to a specific region or area where they already have a presence.

As we have advised our clients, the provision of new capital options through new targeted funds, repurposing of existing funds to pursue a more opportunistic investment strategy, spin-off debt funds from owner/operators, and new partnerships have made the market more competitive for borrowers looking to build, buy, refinance, or renovate. Although the blended cost of capital at similar LTV/LTCs is higher in most cases when compared to pre-pandemic levels, bullish hotel investors are making deals now in hopes of future asset appreciation, at which time they will refinance at a lower cost of capital. As the traditional forms of hotel financing continue to return, these new funds and strategies offer additional options to owners and will underpin the recovery in the hospitality market.

RevPAR By Region—YTD June

Subsequent to the COVID-19 pandemic, several opportunistic funds were raised, and existing funds grew as investors hoped to buy distressed assets at significant discounts, typically 15–35% below 2019 valuations. Few transactions transpired, as per RCA, “between March of 2020 and February of 2021, 8% of hotel sales involved a distressed asset.”[1] Now several groups are sitting on significant amounts of capital waiting to be deployed, and with a recovery for hotels in sight, the opportunity to purchase assets at significant discounts has dwindled. There will be some potential for distressed acquisitions or note sales, primarily in urban markets; however, with limited transactions and several buyers ready with capital at hand, discounted pricing relative to 2019 levels will likely be limited.

As a result of a dearth of investment opportunities and the ramping-up of more traditional forms of financing, several opportunistic or distressed funds have shifted to a lending strategy. These funds are a new source of capital to address deferred maintenance/PIP requirements, acquisitions, and maturing debt, as well as recovery capital as forbearance periods end on loan payments and debt covenants. In commercial real estate, it is always important to understand what financing options are on the table, how to best structure the capital stack, and the trade-offs of each source of capital.

The new funds raised following the onset of the pandemic were typically backed by opportunistic investors who expect a higher return. This translates to higher coupon rates that force these funds primarily into mezzanine or preferred equity positions. These types of groups typically benefit from their ability to transact on complex deals with expedited timelines, which often leads to lending on distressed hotels. Additionally, this subordinated debt commonly comes into play at the end of a project when construction cost materially exceeds the budget. These loans are currently being structured with an 18-month term or longer and are designed to be refinanced with a permanent loan once cash flow reaches stabilization or after construction is completed. However, the track record of these newly formed groups and their ability to execute is a factor borrowers should strongly consider.

Existing lending groups that have experience and exposure to the hospitality industry have new investment vehicles designed primarily to assist in distressed situations due to the timing constraints of a transaction or a cash flow problem at the asset level. Additionally, these groups are on the table for bridge lending related to acquisitions or renovations, as well as new construction financing. Financing products vary greatly and run the capital stack. These loans typically have a shorter horizon between two and three years with options for extensions. These groups are favorable given their historic track record and high likelihood of execution; however, their pricing is still well above conventional and CMBS loans. Furthermore, given these funds’ capital resources, they typically have a large check size with a minimum around $15 million on a 60–75% LTV, which narrows the deals that qualify.

Lastly, we have seen new partnerships that were historically either owners or developers that have expanded their capabilities to encompass a lending arm. These groups typically have a history of success and are able to understand the challenges and opportunities from an operational and development perspective, which is a benefit to borrowers. These partnerships play in a variety of positions along the capital. However, given the scale of these partnerships, their cost of capital is much higher, and the extra expense is typically passed onto the borrower. Additionally, these groups may limit their deal supply to a specific region or area where they already have a presence.

As we have advised our clients, the provision of new capital options through new targeted funds, repurposing of existing funds to pursue a more opportunistic investment strategy, spin-off debt funds from owner/operators, and new partnerships have made the market more competitive for borrowers looking to build, buy, refinance, or renovate. Although the blended cost of capital at similar LTV/LTCs is higher in most cases when compared to pre-pandemic levels, bullish hotel investors are making deals now in hopes of future asset appreciation, at which time they will refinance at a lower cost of capital. As the traditional forms of hotel financing continue to return, these new funds and strategies offer additional options to owners and will underpin the recovery in the hospitality market.

This article was originally published in Hotels Magazine.

[1] Alexis Maltin, RCA Insights, "US Distress Sales Little Seen Except for Hotels." 4/5/21. Retrieved 7/23/21. (Subscription required to access the article)

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error