Wilmington, Delaware enjoys a number of advantages, beginning with its geographical location. Wilmington sits roughly equidistant from two of the East Coast’s foremost pillars of culture, politics, finance, and business: New York City and Washington, D.C. It is well known that thousands of company headquarters are virtually “housed” in Wilmington, also known as the Corporate Capital of the World. But Wilmington’s position along the D.C.–New York corridor has proven advantageous in lifting entrepreneurial efforts off the ground in the city itself. The following article expands upon Wilmington’s leading economic drivers, new developments, and lodging market.

Economic Drivers and Growth

Top industries in Wilmington include finance, pharmaceuticals, law, biotechnology, insurance, manufacturing, education, retail trade, and health care. The recovery of this diverse collection of economic drivers in Greater Wilmington has helped spur growth in the city in the years since the recession. New developments in the Wilmington market include a $210-million, 337,000-square-foot expansion of Christiana Care’s Wilmington Hospital in Downtown; the expanded facility, slated for completion by 2014, will reportedly bring some 600 new, permanent jobs to the city. The Nemours/Alfred I. DuPont Hospital for Children is also undergoing a major expansion that will reportedly comprise an additional five-story, 425,000-square-foot building at an estimated cost of $260 million; this expansion project is also scheduled for completion by 2014.

Major firms active in Wilmington’s financial sector include JPMorgan Chase, M&T Bank, Wilmington Savings Fund Society, ING Direct, Barclays, and Bank of America. According to market participants, Bank of America is planning to expand their data center capacity in Delaware, while JPMorgan Chase plans to increase operations in Wilmington and add up to 1,200 new jobs within the next two years.

Downtown Revitalization and Development

Major revitalization and expansion projects underway in Downtown Wilmington should help stimulate additional business and room-night demand for area hotels. Along with the aforementioned Wilmington Hospital expansion, the Wilmington Riverfront and Market Street have been the focus of a long-term revitalization initiative in the city. The transformation of a once-vacant industrial warehouse shipyard along the Riverfront into a leisure destination has made great strides over the years; the Riverfront’s variety of commercial and residential uses spans office buildings, multi-family housing, restaurant and retail venues, and several of the area’s larger entertainment venues, including Frawley Stadium (home of minor league baseball’s Blue Rocks) and the Chase Center. The state-of-the-art Penn Cinema Riverfront & IMAX complex, which opened in December of 2012, is estimated to bring an additional 700,000 visitors to the Riverfront annually—an encouraging forecast for hotel demand in coming years.

New Hotel Supply

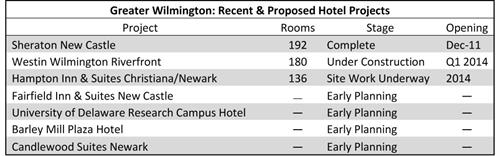

As noted in the following chart, several hotel projects in the greater Wilmington area have either broken ground or are in the early planning stages of development.

Construction of a $37-million Westin hotel broke ground in July of 2012 at the Wilmington Riverfront; the hotel will be attached to the Chase Center, whose 87,000 square feet of meeting space make it the largest events venue in Greater Wilmington. The proposed 180-room Westin is scheduled to open by the first quarter of 2014 and will reportedly bring 290 new jobs and generate $3.9 million in state and city tax revenues in its first three years of operation.

Lodging Performance and Forecast

Occupancy in the Wilmington Metropolitan Statistical Area dropped off slightly in 2012 when compared with levels from 2011, reportedly due to a decrease in corporate transient travel, particularly within the financial services sector. Wilmington hotels commanded a stronger room rate in 2012, which increased RevPAR 2.4% over the previous year. Nonetheless, the Wilmington hotel market’s RevPAR, while higher than that of New Castle County, sat slightly below that of the state and much lower than that of the nation because of further cutbacks in corporate spending from the area’s major room-night demand generators. The table below depicts comparative data on occupancy, average rate, and RevPAR for the Wilmington MSA, New Castle County, Delaware, and U.S. hotels for 2011 and 2012.

Reports from market participants suggest the Wilmington area is poised for a moderately more aggressive RevPAR improvement for 2013 over levels from the past year, with area hoteliers focusing primarily on driving room rate; however, based on the still-sluggish business climate for the area’s major financial institutions, HVS forecasts overall RevPAR improvement of around 5.0% for the Wilmington market in 2013, which is slightly lower than the forecast of 5.8% for the nation.

Conclusion

RevPAR levels for Wilmington hotels should strengthen in the near term, particularly as existing hotels continue to drive room rate. The area’s reviving and diverse customer base, along with the increasing economic calm following years of recessionary tempest, have allowed hoteliers to renegotiate room rates with local businesses over the last two years—a big help to the market’s overall rebound since the trough of 2008/09. Higher-rated new supply scheduled to enter the Wilmington/Newark area over the next two years should further drive room rate increases for the market, making for a favorable outlook for Wilmington hotels over the long term.

Sounds like a lot of great things happening more recently in this market. Great article, good job, you two!